Periodically, I try to refresh my views on financial markets so that I can adequately manage my portfolio. The last time I ran through this exercise was early February, and it seems I had a solid handle on market dynamics then. Hopefully this remains true today.

I’ve recently consumed several pieces of content that are playing large roles in my updated market perspective. If you prefer to go directly to the sources and skip my sloppy synthesis, here are the links (I’ll attach my notes at the end of this post):

- Stan Druckenmiller Interview

- Jeffrey Gundlach Interview

- David Einhorn Presentation

- Lyn Alden Newsletter

I generally assess the market on a 6-36 month time horizon. If you make investment decisions with a time horizon outside of this window, my conclusions may be pretty irrelevant (ignoring the fact that I may be dead wrong WITHIN my time horizon). The question I’m trying to answer is: How should I position my portfolio amongst the various asset classes?

Fixed income (Interest Rates)

Interest rates play a role in the valuation of almost all asset classes. The 10year treasury yield is the most important financial price in the world. Consequently this section is the longest. My framework boils down to: Inflation -> Monetary Policy -> Treasury Market -> Trading.

Inflation

Gundlach forecasts that the next couple of CPI prints will have 8-handles. He sees very little chance that inflation returns to the 2% target in the next 1.5 years. I agree, primarily because inflation has shifted from a demand driven phenomenon via fiscal stimulus, to a supply driven phenomenon via lack of commodity capex (these past several years). The war in Ukraine has exacerbated the supply-side issues, but the underlying de-carbonization sentiment existed pre-conflict, and this theme has influenced investors to pressure companies away from spending capital on the production of dirty resources.

Just look at the tepid (rig deployment) response from US oil producers while prices have consistently traded $70+ (and more recently in the $100s) for a year!

My key assumption is that inflation will not return to the 2% target ~naturally~ because the supply side drivers are not changing anytime soon. That implies the demand side will need to do most of the work to ~normalize~ inflation.

*It is possible we flip to a deflationary environment, although I think that is unlikely. Druckenmiller mentioned that history suggests the larger the asset bubble, the larger the resultant deflation (and we are in the midst of quite a large bubble). He also said that this environment has no historical analogue, and that he sees the probabilities as 70% inflation / 30% deflation.

Monetary Policy

The Federal Reserve is legally obligated to seek stabile prices and maximum employment. The Fed is now quite clear on its intentions: it will tighten monetary policy until inflation is tamed, regardless of how this policy affects employment and the broader economy. Or said differently, The Fed WILL slow down the economy and consequently increase unemployment UNTIL inflation materially slows down.

Druckenmiller mentioned that historically, once inflation crosses 5%, it has never come down until the fed funds rate surpassed CPI. If this pattern were to hold, the Fed Funds rate would need to climb to 8% from its current level of 1.75%. Does The Fed actually have the ability to increase rates this much? I believe there are several scenarios that would cause The Fed to pause (or reverse) its monetary tightening even if inflation remains elevated. Some examples:

- A financial market meltdown (say stocks decline 25% from here)

- A severe economic recession (say unemployment spikes to 7%)

- US gov liquidity issues

- Einhorn mentioned that for every 1% increase in rates, $70 billion is added to next year’s fiscal deficit in the form of higher interest payments. The US treasury may only be able to handle limited rate increases before facing an untenable fiscal situation.

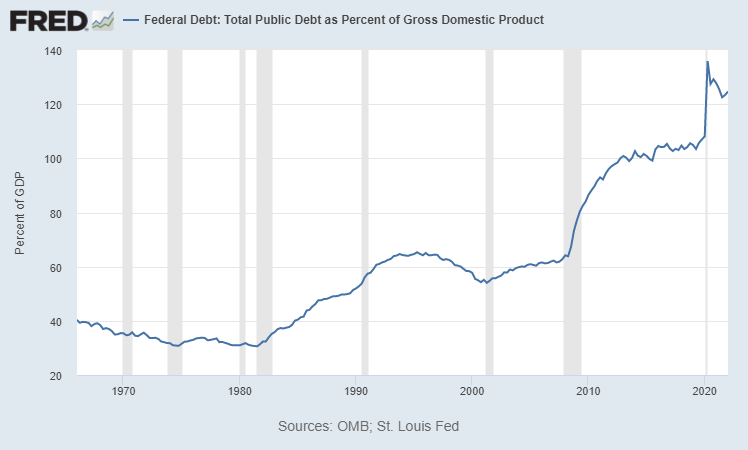

One of the primary differences between today and when Volcker crushed inflation in the 1970s/early 1980s is the amount of debt in the system. More debt = larger absolute increases in interest payments when rates rise.

All of this is to say, I believe The Fed is limited in its capacity to fight inflation because the current environment consists of: a massive asset bubble, record-breaking amounts of debt, and supply side issues that aren’t changing anytime soon.

My assumption is that The Fed will continue to tighten monetary policy until inflation slows down OR something breaks (i.e. one of the aforementioned events occurs).

Treasury Market

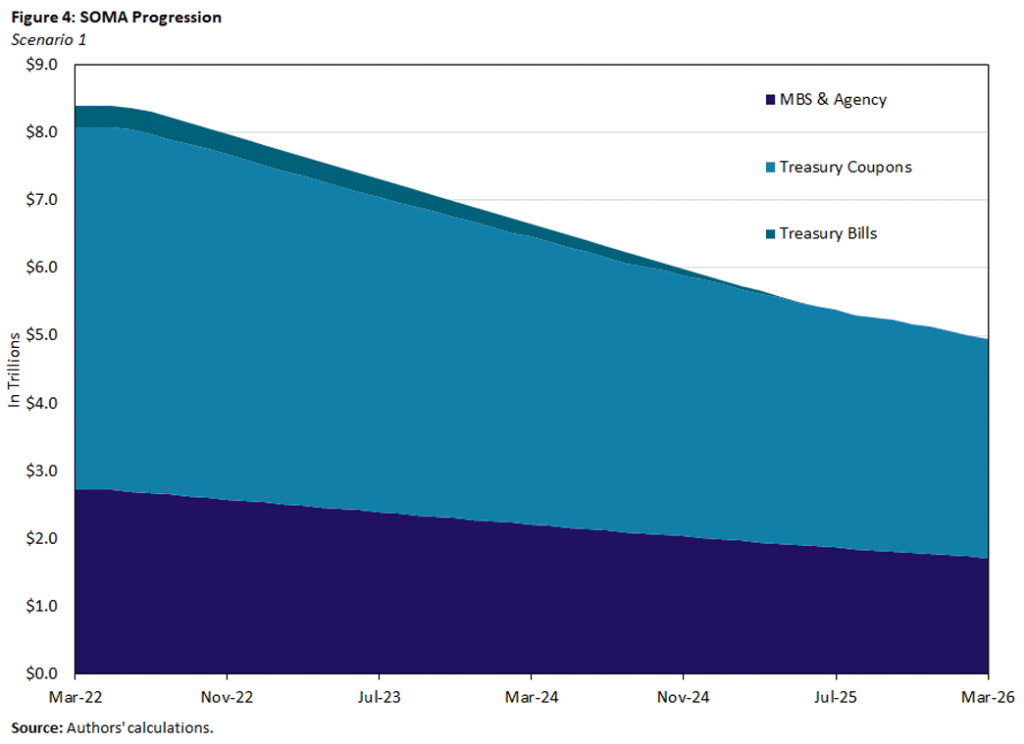

The Fed employs two primary monetary policy levers: it manipulates the fed funds rate (overnight lending rate) and it employs quantitative easing/tightening strategies by growing/shrinking its balance sheet (comprised mostly of treasury bonds, but also some others such as MBS).

While The Fed continues to raise the fed funds rate, it has also begun shrinking the amount of bonds on its balance sheet.

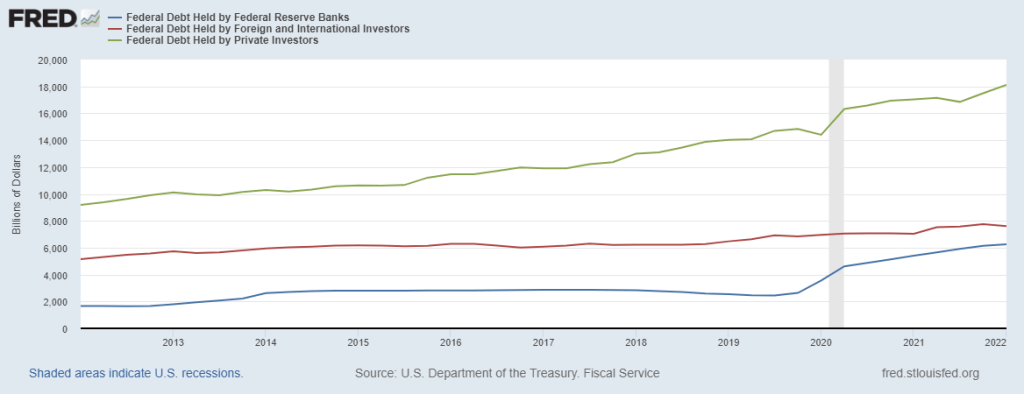

Furthermore, Einhorn noted that the Dollar has been losing its global reserve currency status, and that China has potentially begun to shift away from holding large quantities of US treasuries. China is the second largest foreign owner of treasuries after Japan.

The Fed is shrinking its treasury holdings. Foreign investors’ holdings of treasuries may also flatten or decline. Given the US government deficit continues to increase, this implies private investors will need to own an even greater share of treasuries than they already do. That will happen, but at what price? The 10 year treasury yields 3.27% at time of writing while inflation is running at 8%. Would you buy that bond?

Trading

What does this all mean for my fixed income exposure?

- I think interest rates will continue to push higher, but I think ~something will break~ sooner rather than later. If that happens, rates could plummet (but also they might not given inflation…).

- So basically, rates probably don’t have that much upside, but they also might have limited downside, and thus I don’t see a compelling risk/reward opportunity.

- I’m still short treasuries (TBF), but given my updated view I think it’s time to sell this position.

Stocks

Fortunately, my evaluation of the stock market is much more concise now that we have covered interest rates. You can calculate the fair value of the stock market (in this case the S&P 500) by making assumptions about three variables:

- Earnings growth

- Interest Rates

- Equity Risk Premium: the return investors require over the risk free rate (10 year treasury yield)

Luckily there is this amazing site called macrofade that calculates this equation for you based on your assumptions for these variables. (For those who aren’t aware…full disclosure…it’s my site). Also, for those interested the equation is here.

What are my equity market assumptions (using a 1 year time horizon for this exercise)?

Earnings Growth

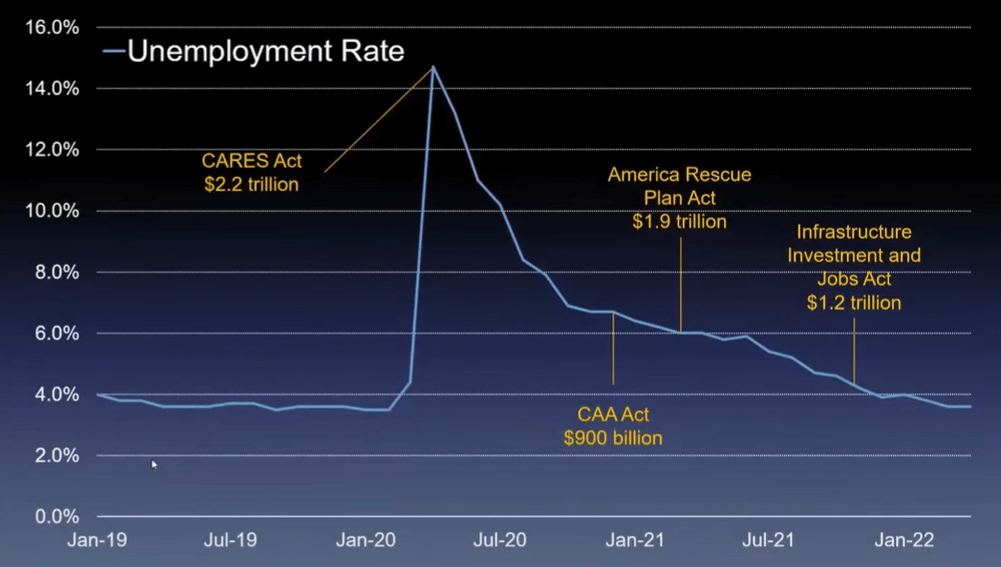

Let’s talk about the economy. Not good. 1st quarter GDP growth came in at -1.5%. 2nd quarter GDP growth is currently forecasted at 0% according to the Atlanta Fed’s Nowcast. Could things turn around in the 2nd half of the year? Unlikely: the economy will have to fight tightening monetary policy and face an absence of fiscal stimulus (compared to most of the Covid period – see below for the stimulus timeline).

Analysts are forecasting 7-8% earnings growth over the next year. I’m a bit more bearish and will plug in 6% earnings growth to the model.

Interest Rates

As noted earlier, I think interest rates will continue to increase until something breaks. I’m going to assume the 10yr yield at 3.5%, just a hair above where it sits today.

Equity Risk Premium

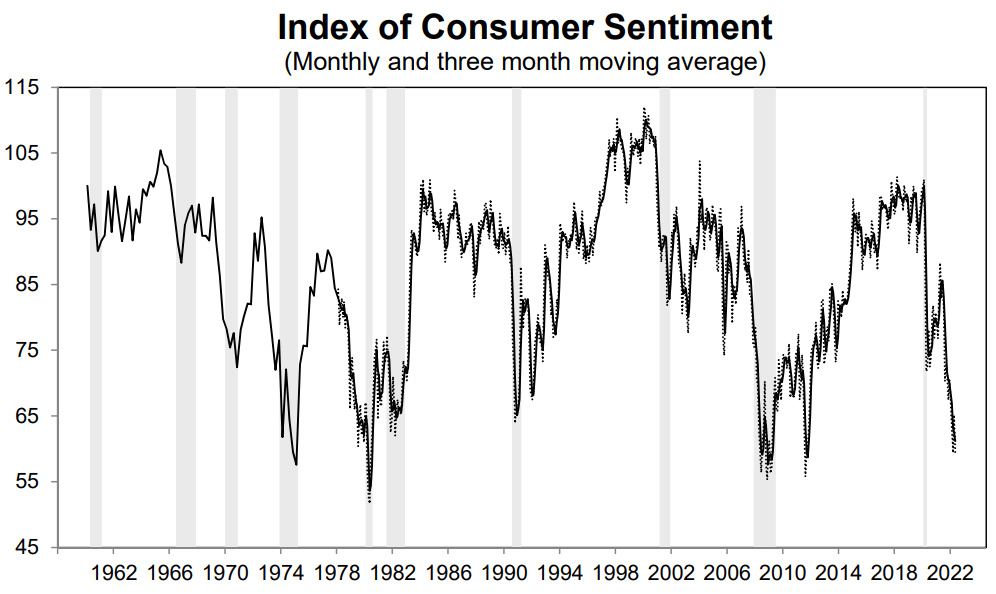

This variable is a bit fluffy, but it can be thought of as investor sentiment. In an inflationary, rising interest rate environment where consumer sentiment is near all time lows and The Fed is engaging in quantitative tightening, there is reason to believe investors are (and will be) fearful.

I’m going to assume an equity risk premium of 2.5%.

Trading

Drum roll please. These assumptions suggest a S&P 500 fair value of 3,500. That is about 7% lower from the 3,765 it trades at today. I do think most of the tail risk sits further to the downside. If ~something breaks~ equities may drop far more than 7% from here. Unfortunately options are not cheap to own (the VIX sits at 31).

I clearly don’t want to be long equities. But I struggle to trade equities from the short side (am I really going to double down when the market rips 20% higher in my face?). So basically I’ll wait for the market to rally and/or the VIX to come down before getting involved in selling the market short. Sadly no trades here either.

Gold

Sky high inflation? Check. Negative real interest rates? Check. Massive fiscal deficits? Check. Geopolitical turmoil? Check.

All fundamental drivers of gold point to an extremely supportive environment for the shiny rock. But it has not traded nearly as high as I would have thought. Why? I don’t have a great answer. Maybe crypto sucked up a lot of the money that would have otherwise gone to gold. Maybe it is a relic that does not have a place in modern central banking. Maybe everyone who is bullish already has their max position on and there is no one left to buy. Or maybe we are about to enter a massive deflationary episode as the everything bubble continues to pop. Je ne sais pas.

Einhorn’s presentation is a pitch to own gold, so if you want the details, watch it (only 20ish mins). His thesis boils down to:

- Monetary debasement is the only way out of our fiscal situation

- The Fed is likely to stop raising rates before it tames inflation because our government fiscal situation cannot handle higher interest rates

- The dollar is losing its reserve currency status and foreign central banks will increase their holdings of gold as a reserve asset

I’ve been in this gold trade for what feels like an eternity, and it hasn’t traded how I expected. That is cause for re-evaluation. But frankly, the fundamental picture still makes sense to me. Just because it hasn’t worked yet…doesn’t mean it won’t.

I’m staying long.

Industrial Commodities

Ironically given my previous job, I have very little confidence trading industrial commodities because I am acutely aware of all of the things that I no longer closely follow. So I’ll keep this short.

Commodities have ripped higher due to supply side dynamics. These dynamics will not change soon (at least in oil, the most important industrial commodity). Commodity prices have also skyrocketed. Bullish commodity positioning is a consensus view. So what to do?

I’m still long commodities, but not to a major extent. I think holding a small position makes sense, but I certainly don’t have conviction to size up the position at these prices. I’ve dabbled with some energy related options, and will probably continue to putz around there. So basically, marginally bullish but not sure of the opportunity attractiveness.

Real Estate

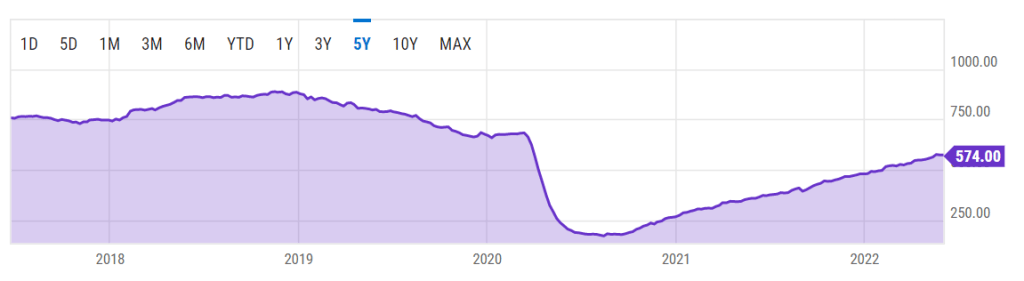

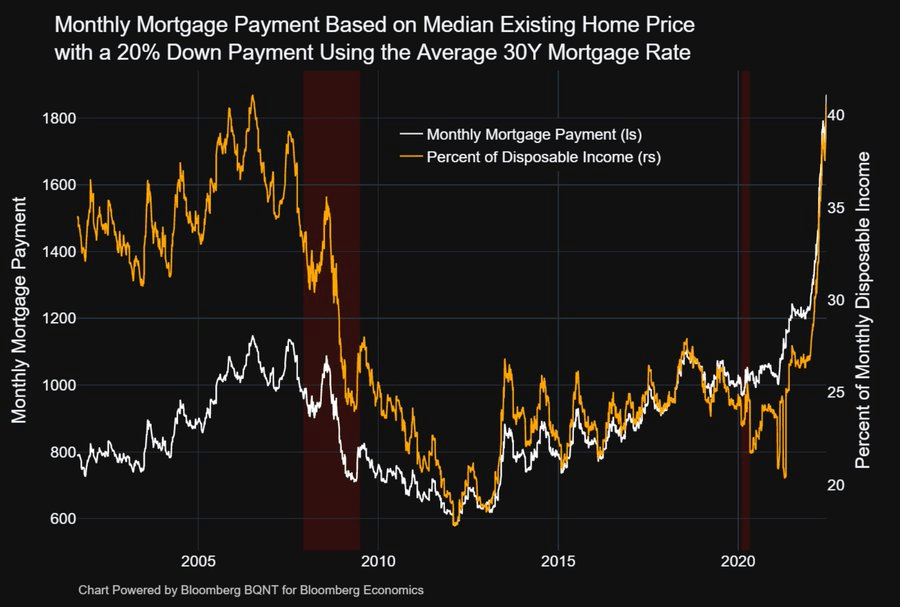

Now I’m really leaving my “circle of competence”. For the record, I’ve never traded real estate related securities before. But this chart tells me a lot about the residential market:

The cost to service a mortgage payment on the median American home is up ~60% in 6 months. I’m no expert, but that is BAD for residential home demand.

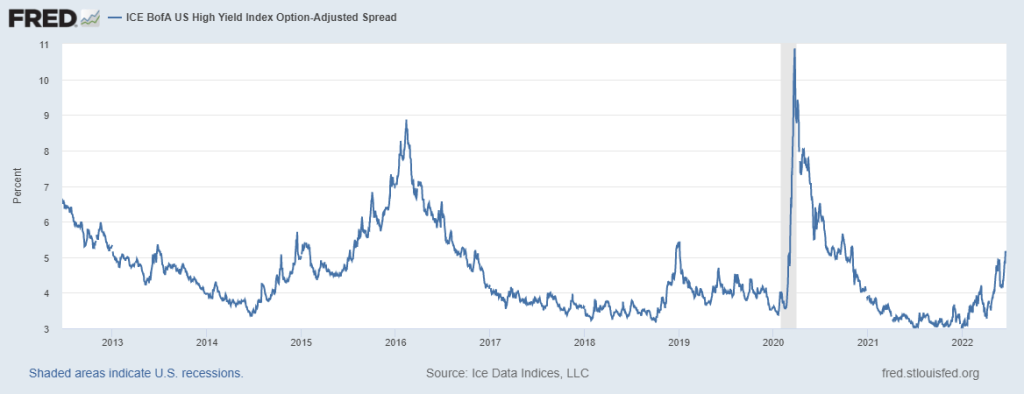

On the commercial side I really have no idea, but corporate credit spreads are on the rise. This may also portend weakening demand.

Summary

To wrap it all up, my trading views:

- Fixex income – neutral

- Stocks – bearish, but waiting

- Gold – bullish, but exasperated

- Industrial commodities – bullish, but scared

- Real Estate – Confused, but predicting pain

This is the least attractive opportunity set I’ve seen since I began trading (an admittedly short time period). I would love to build a large cash position, but that also hurts while inflation runs hot. Gold is the only trade I like in meaningful size, but it makes me uncomfortable. I think I might increase my cash position with the hope that better opportunities arise sooner rather than later. Hemorrhaging purchasing power via cash is at least better than owning an asset with negative expected value.

To reiterate: you can run, but in this market I’m not sure that there is anywhere to hide.

Appendix: My Notes

- Inflation came in higher than expected

- Equity market bubble has burst pretty dramatically, some companies down 60-70% with little change in fundamentals

- Thinks we are 6 months into a bear market that has a ways to run

- Thinks a soft landing is very unlikely – we’ve never had one once inflation has passed 4.5%

- Historically once inflation has passed 5%, it has never come down until fed funds has surpassed CPI

- Thinks fed funds won’t get there this time – will have a major financial meltdown before then

- Thinks a recession is coming, but not sure when. Consumer has a buffer with all of their excess savings, but once that is worked through…

- Crypto has destroyed 1 trln of welath – there will be effects

- If you believe in irresponsible monetary policy and inflation continuing –

- If we are in a bull phase, own bitcoin

- If we are in a bear phase (for other assets), own gold

- Assuming inflation/stagflation type environment

- This is based on his observations rather than a fundamental rationale

- Big tech far less overvalued and not worth going short here

- Sees structural bullish energy market. It is very consensus, but still compelling

- The main thing to crush this one is a massive global recession

- He has never seen an investing environment like this one in his 45 year career

- The bigger the asset bubble, the bigger the successive deflation

- Fed is raising fed funds to 3% by September-ish

- Their model sees 8 handle inflation for next couple of months

- 7% inflation for year of 2022

- Group of economists think inflation is underreported by 4-5% due to various adjustments used in calcs

- It is very hard to believe inflation will come down to 2% in next year and a half

- The fed follows the 2 year

- Bond market liquidity is deteriorating

- Expects short-term rates to continue to rise through the summer

- If inflation does not come down below 6, he thinks Powell will really need to ramp up rate hikes

- Powell wants to get to positive interest rates, requires really low inflation

- Economy is not strong, GDP was negative in 1q, and Atlanta Fed GDPnow sees 0 for 2q

- Recession is extremely likely

- The fed will not stop tightening unless there is significant damage in markets or the economy

- Usually someone blows up in this environment (My note: Tiger Global..)

- Very bearish on dollar long-term, had been bullish short term but that is changing

- Thinks dollar will fall in next recession

- Thinks fed will go to 0 rates very quickly in next recession

- Thinks commodities deserve a structural portfolio position

- Kind of neutral on US stocks now, looking to buy EM stocks eventually

- Some of their models now think the 10yr treasury yield is too high, kind of weird

- He could see the yield coming down in short-term

- Bullish gold

- Fiscal profligacy is bipartisan

- Obama ended with a shrinking deficit, but then covid hit and the deficit exploded

- Covid fiscal programs:

- CARES Act, Mar 20, 2.2 trln

- CAA Act, Dec 20, 900 bln

- America Rescue Plan Acr, Mar 21, 1.9 trln

- Infrastructure Investment and JObs Act, Nov 21, 1.2 Trln

- US debt-gdp has exploded

- Fed owns 19% of all treasury securities

- Even though the labor market is strong, we still expect 4% fiscal deficit (of gdp)

- US demographic situation is deteriorating

- Social security trust funds predicted to go bust in 12 years

- Social security is a net seller of treasuries

- Social security trust funds predicted to go bust in 12 years

- ESG directives have driven up cost of capital for energy and industrial companies

- This has driven the structural commodities bull market, and this dynamic is not changing

- Thus combatting inflation will need to come from a demand slowdown

- Today’s inflation is similar to the 1980 peak when you remove the adjustments

- Fed is limited in how much it can raise rates because of the federal gov debt load

- 24 trln in debt held by public (fed debt held by non gov entities)

- 7trln rolled next year

- Every 1% increase in rates add 70 bln to deficit (in the first year)

- 7trln rolled next year

- 24 trln in debt held by public (fed debt held by non gov entities)

- My note, this is interesting: https://bipartisanpolicy.org/report/deficit-tracker/

- US has weaponized dollar – it can no longer serve as global reserve currency

- China owns over 1.1 trln of us gov debt

- May shrink this

- Russia has been selling treasuries, buying gold

- If central banks lose faith in US, gold becomes the default reserve asset (it is already accepted as a reserve asset amongst banks, and has a long historical precedent, unlike crypto)

- Ultimately thinks the fed is bluffing that they will do “whatever it takes” to fight inflation

- Or really that the fed can’t go past 3 or 4%

- Thinks the fed will stop fighting inflation before it bankrupts the treasury

- Sees the 1940s (vs the 1970s) as the closest historical analogue to today’s environment

- The fed has not quickly raised interest rates because of very high debt/GDP

- History suggests that when debt gets this high the only way out is to default in some form

- Currency devaluation is the solution for countries whose debt is denominated in their own currency – i.e. inflate your way out

- Fiscal stimulus is beneficial longer-term when it goes towards investments in people or things that increase productivity

- The 1940s stimulus was productive whereas the 2020 stimulus was less so

- Developed world demographics are challenged (older populations) and thus make fiscal austerity very difficult

- If rates were raised to current inflation levels the world would experience widespread insolvency

- In the 1940s the Fed implemented yield curve control, where they held short-term rates near 0 and capped long-term treasuries at 2.5%

- Official inflation averaged 6% for the decade

- The fed is basically forced into trying to increase unemployment (through tighter monetary policy), which they hope will lead to a balancing of supply and demand (combatting inflation)

- Econ indicators:

- Q1 negative gdp, Q2 nowcasted at 0

- Awful consumer sentiment

- Negative y/y retail sales

- Jobless claims ticking higher

- Industrial production looks healthy

- The cost of paying a mortgage on the same house vs a year ago is +65%

- Factoring in the increase in home prices and mortgage rates

- When Paul Volcker raised rates to 19% in the 1980s, total debt/GDP was 160%. Today it is 370%.

- Tightening US monetary policy will hit EM countries with dollar denominated debt

- If the fed is successful in destroying demand and slowing inflation, inflation will pop back up as soon as policy is loosened because the supply side needs several years to catch up

- A lot more…but basically saying central banks are in a massive quagmire unless inflation begins to materially slow

Very interesting

LikeLiked by 1 person